Developing a data-driven Total Addressable Market (TAM) is essential for sustainable growth. As a Paid Media Operations Manager, I’ve learned that a successful TAM strategy isn’t simply about identifying anyone who can become a customer—it’s about understanding what type of customers are most likely to turn into revenue. Here’s my detailed, practical guide to creating an effective TAM, using insights and examples from our approach at Directive.

Step 1: Compile Your 1st-Party Data

Begin your TAM strategy by gathering your first-party pipeline data—information you already have within your CRM. At a minimum, you’ll want to look at all closed-won, but it can also be valuable to include closed lost, allowing you to dig into close rates later.

Create and export a report that includes the company name, company URL, opportunity stage, and total contract value as a starting point.

Step 2: Enrich Your Data

Now you’ll need to enhance your first-party data through a data provider such as Zoominfo. Enhancing your data provides more context to the companies in your pipeline and allows you to understand which specific data points correlate to more revenue for your business.

You’ll get insights such as department budgets, primary/sub-industries, employee ranges, revenue ranges, and more! These new pieces of data shed light on your pipeline and will help you identify trends that correlate to revenue for your company.

Step 3: Pivot, Pivot, Pivot!

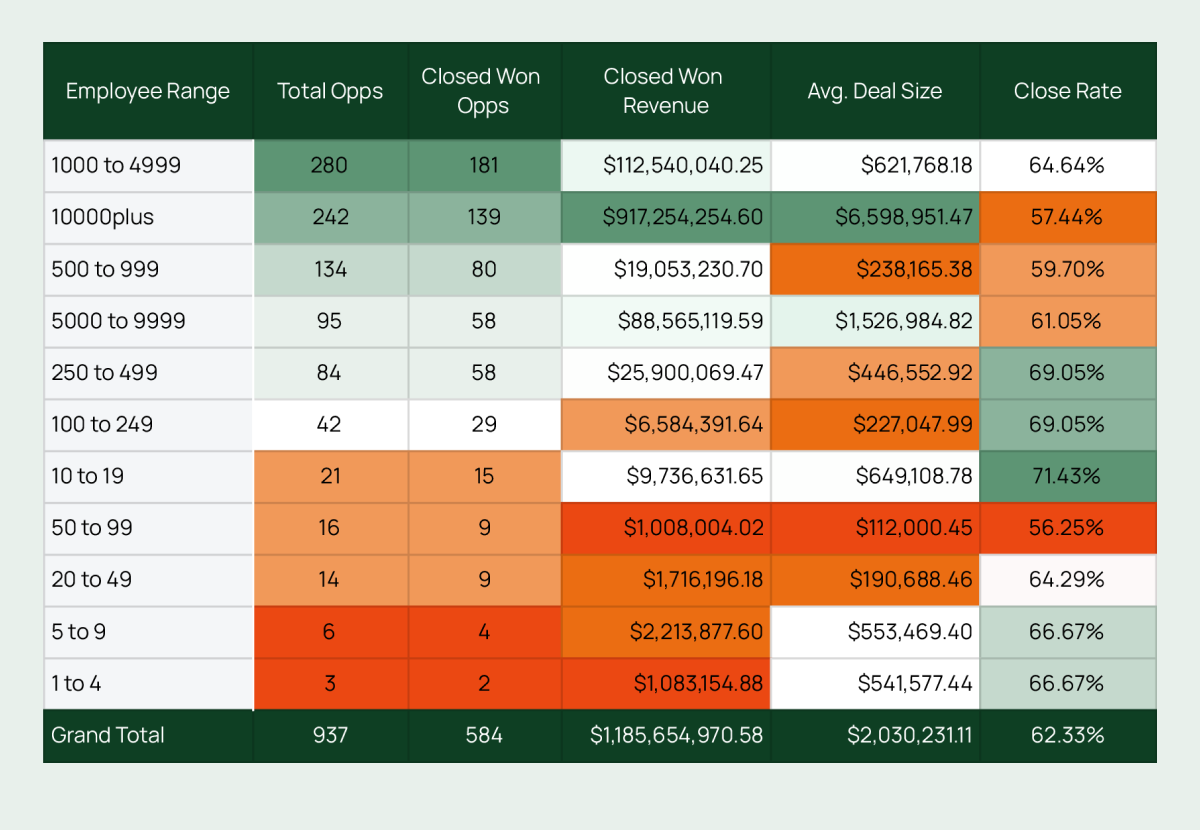

Running pivot tables will help you hone in on data points that may be valuable for your business. Identifying these will become the building blocks of your TAM. Let’s take a look at an example where we look at a customer’s data as it relates to employee range:

We can see above that while the majority of the opportunities are coming from companies with 1,000 – 4,999 employees, the bulk of actual closed won revenue comes from companies with over 10,000 employees (and look at how much more lucrative they are, too).

Rather than try and build a target account list appealing to everyone, this TAM would focus specifically on companies with over 10,000 employees; the data tells us these are our best-fit customers.

Don’t stop there, though! We need to continue looking at other data points and their correlation to closed won revenue. Other data points we like to explore within our pivot tables that often give us a clear direction of what to focus on are:

- Primary Industry (Ex: Software)

- Sub/secondary industry (Ex: Financial Software)

- Department-specific budgets: If related to your offering.

- For example, “marketing dept. budget” is a good data point for Directive to look at, as we know this will correlate to a company’s ability to hire us

- ZoomInfo also provides HR department budget, as well as IT department budget

- Ownership type: Public or private?

- Business model: B2B or B2C?

- Recent funding round

- Company country: Applicable if your company is international

Step 4: Consolidate and Validate with Precision

Now that you’ve got the core criteria of your best-fit customers, you can plug those criteria into your data provider to build a list of all companies that match. This will give you your TAM first draft.

We say “first draft” because the list building does not stop there; every entry should undergo manual verification combined with AI-driven validation. This step ensures data quality, accuracy, and relevance, eliminating wasted spend on irrelevant or inaccurate targets. While data providers will have a lot of great, up-to-date information, it won’t always be 100% accurate. Check out how this provider has us tagged as “SaaS”:

While we do provide services for SaaS companies, we aren’t a SaaS company. So if your TAM is built to target SaaS companies, some of your ad dollars would be wasted serving ads to us. This is why it is crucial to manually verify your TAM list.

Combining human oversight with advanced AI techniques ensures no ad dollars are wasted on companies that aren’t perfect fits for your sales team.

Step 5: Refine and Continuously Optimize

Developing a successful TAM isn’t a static exercise. Continual refinement is essential. Regularly update your TAM by checking for changes in market conditions, emerging opportunities, or shifting buyer behavior. Ongoing refinement has allowed us to keep our targeting agile and responsive, continuously improving campaign effectiveness.

Strategic Segmentation for Maximum Impact

Effective segmentation can work in your favor in this exercise. For example, if your TAM contains multiple high-performing industry segments, and you are getting feedback from sales that they are having success speaking with cybersecurity companies, you could segment them out into their own list. This allows you to:

- Tailor ad copy specifically to that segment, likely improving conversion rates

- Focus more ad spend there, versus being spread around other companies within your TAM

“Why not just segment from the start?” Great question. We’ve found it to be more effective to start wide, and let the data flow in to tell us how we can further segment to improve performance. This ensures we do not over-engineer from the start. We’ll also see better CPMs from the ad platforms and provide them with more data upfront to optimize versus spreading ourselves too thin from the get-go.

Strategic segmentation leads to more precise targeting and deeper audience resonance, enhancing the overall effectiveness of marketing efforts.

Integrate TAM with Account-Based Marketing (ABM)

Integrating your TAM strategy with Account-Based Marketing ensures alignment across your sales and marketing teams. By leveraging precise, validated TAM data, your ABM initiatives become more coherent and targeted. We’ve seen firsthand how seamless integration into ABM strategies improves overall campaign efficiency and results.

Translating TAM Insights into Real-World Success

A carefully executed TAM strategy leads directly to measurable business outcomes, such as reduced wasted ad spend, increased engagement, higher conversion rates, and a happier sales team closing more deals.

We’ve witnessed tangible results, including a significant reduction in wasted ad spend of 10–30% and improved campaign effectiveness by accurately identifying high-value opportunities previously overlooked.

Follow these steps to create an insightful, actionable, and high-performing TAM strategy tailored to your business objectives.

Ready to Build a Stronger TAM?

An effective TAM approach isn’t simply about data—it’s about strategically applying that data to drive growth. We’re essentially taking the approach ad platforms take when they build a “lookalike audience”. The key difference is we’re in the driver’s seat; there is no “black-box model” or questions about what factors the platform decided to leverage to build the list. We see, analyze, and manually verify the data ourselves to understand the types of customers our sales team cannot wait to speak with.

Stop guessing. Start targeting only the companies that actually close. Book a 29-minute strategy call with our media ops team and get a custom TAM analysis—no fluff, no filler.

-

Paid Media Operations Manager Max Serrato

Did you enjoy this article?

Share it with someone!