What is Customer Churn Rate?

Customer Churn Rate (also known as customer attrition rate) is a B2B SaaS business metric that measures how many customers or subscribers your business loses in a given time period.

Why is Customer Churn Rate Important?

Customer churn rate is a crucial metric for your B2B SaaS business to measure and optimize.

A low churn rate shows that your product is effectively solving problems for your target market, while a high churn rate shows that (at least some) customers aren’t seeing genuine value from the products and services you provide.

Measuring churn rate allows you to:

- Quantify customer satisfaction and understand how well your company is solving problems for your target market.

- Understand and project the financial impact of customer churn on overall revenue and profitability.

- Identify strategies to mitigate churn and improve customer retention.

How to Calculate Customer Churn Rate

To calculate a customer churn rate, you’ll need to:

- Choose a time period. Customer churn rates may be calculated on an annual basis, but most B2B SaaS companies keep frequent tabs on customer churn by measuring every month.

- Know how many subscribers you have at the beginning of the time period (Initial Subscribers).

- Know how many subscribers cancelled during the time period (Lost Subscribers).

Here’s the formula for calculating Customer Churn Rate for a given time period:

Customer Churn Rate = [Lost Subscribers Initial Subscribers] 100%

Example 1:

A B2B SaaS company wants to calculate its customer churn rate over the past 30 days of operation. The company had 134 paying subscribers at the beginning of this time period. By the end of the 30-day period, 8 of those customers had cancelled their subscriptions. The company can calculate its customer churn rate as:

Customer Churn Rate = [8134] 100%

= 5.97%

How to Calculate Revenue Churn Rate

The customer churn rate formula lets you measure customer attrition by calculating the rate at which you’re losing subscribers, but you could also measure customer attrition in terms of lost revenue.

To do that, you’ll need to use the revenue churn rate formula.

Just like when you’re calculating customer churn, you’ll need to specify a time period for your measurement. You’ll also need to know how much MRR or ARR you had at the beginning of the time period, and how much MRR/ARR you lost to downgrades or cancellations during that time period.

Here’s the formula for calculating revenue churn rate:

Revenue Churn Rate = [Lost MRR Initial MRR] 100%

Example 2:

A SaaS business wants to calculate its revenue churn rate over a 30-day period. The company had $25,000 in MRR at the beginning of the period, but lost $2,200 in MRR to service downgrades and cancellations during the 30-day period. The company can calculate its revenue churn during the 30-day period as:

Revenue Churn Rate = [$2,200 $25,000]100%

=8.80%

Customer Churn Rate vs. Retention Rate - What’s the Difference?

Customer Retention Rate is a SaaS marketing metric that measures the ratio of subscribers that a company maintains in a given period of time.

Customer retention rate is basically the inverse of customer churn rate. Instead of calculating how many subscribers you lost, a retention rate tells you how successfully your business retained customers over a given time period.

To calculate your customer retention rate, you’ll need three data points:

- Initial Customers – The number of subscribers you had at the beginning of the specified time period.

- Final Customers – The number of subscribers you had at the end of the specified time period.

- New Customers – The number of subscribers you gained during the specified time period.

The formula for calculating customer retention rate for a given time period is:

Customer Retention Rate =(Final Customers – New Customers)Initial Customers100%

Example 3:

A SaaS company wants to calculate its customer retention rate during a 30-day period. At the beginning of the period, it had 1,500 subscribers. During the 30-day period, it gained another 150 subscribers. By the end of the 30-day period, the company had a total of 1620 customers. The customer retention rate can be calculated as:

Customer Retention Rate = (1,620 – 150)1,500100%

= (1470) 1500 100%

=0.98 100% = 98%

If the company started with 1500 customers, added 150, and finished with 1620, that means there were a total of 30 lost subscribers during the 30-day period. With this piece of information, we can calculate customer churn rate during the same period:

Customer Churn Rate = (301500)100%

=0.02100%=2%

As in this example, the customer retention rate and customer churn rate for a given time period should add up to 100%. This indicates that every customer is either lost or retained during that period, and demonstrates the inverse relationship between these two metrics.

What is a Good Customer Churn Rate?

Ideally, you’d love to run a business with 0% churn, one where your hard-earned customers never defect to a competitor or stop using your service.

But in reality, that doesn’t happen very often.

If you’re an early-stage company that’s yet to establish a strong product-market fit, it’s not uncommon to see churn rates of 30% or more. Even when your product delivers great benefits to your ideal customer, you will still occasionally win customers who struggle to implement or generate value and will inevitably churn.

Across industries, average churn rates for successful companies typically range between 5-10%. An annual customer churn rate of ~3% is considered excellent, while a churn rate of more than 20 or 25% might indicate that your product fails to meet customer needs, or that you’re targeting the wrong customers.

How Does Customer Churn Rate Correlate with Marketing Success?

With Directive’s Customer Generation methodology, we aim to generate three dollars of customer lifetime value (LTV) for each dollar spent on customer acquisition costs (CAC). We call this maintaining a 3:1 LTV:CAC ratio.

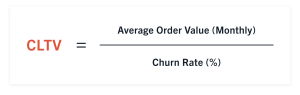

LTV can be calculated as:

This LTV equation shows the importance of minimizing churn to achieve a 3:1 LTV:CAC ratio and a profitable marketing strategy:

Doubling your monthly churn rate results in a 50% decrease to LTV and LTV:CAC ratio, while halving your monthly churn rate results in a 100% increase to LTV and LTV:CAC. Ultimately, minimizing churn means that you’ll generate more revenue per customer, run a more profitable marketing program, and accelerate the growth of your business.