Many B2B marketers still chase customer acquisition over retention. Big logos signal momentum, impress the board, and look great on a website. But without a deliberate retention strategy, every new deal risks leaking revenue out the back door. You might hit this quarter’s targets, but next quarter you’ll be scrambling just to replace what was lost.

And when B2B customer retention strategies do exist, they’re often little more than fire drills, reacting to churn instead of preventing it.

Companies wait for usage to drop, NPS and CSAT scores to decline, or renewal dates to creep closer, then scramble to re-engage. By the time action is taken, the risk is already active. In many cases, it’s already too late.

But what if retention didn’t have to be reactive at all? What if your team could anticipate risk and act before churn becomes a problem?

That’s the promise of predictive retention modeling.

By using behavioral data, product telemetry, and account-level signals, B2B companies can detect churn risk earlier, personalize interventions, and, more importantly, turn retention into a source of net new growth.

B2B retention strategies rooted in predictive modeling:

- Improve Customer Acquisition Costs (CAC) payback and lower churn

- Increase Net Revenue Retention (NRR)

- Compound Customer Lifetime Value (LTV).

- Drive capital efficiency quarter after quarter, without adding pressure to your acquisition engine

Yet despite all that, many companies still operate without structured B2B SaaS customer retention strategies or B2B customer retention strategies, and even fewer use predictive tools to stop churn before it happens.

This guide is for B2B and SaaS teams ready to move beyond reactive retention. You’ll learn why traditional approaches fall short, how predictive modeling works, which behavioral signals to track, and how to design proactive plays that reduce churn, increase NRR, and improve LTV and CAC efficiency, turning retention into a true revenue growth engine.

Predictive Retention Modeling: Deploying Smart Loyalty Incentives to Slash Churn

Predictive retention modeling helps B2B and B2B SaaS teams reduce churn and drive loyalty by turning behavioral data into proactive retention plays. When executed correctly, it becomes a scalable system that surfaces risk early, guides team actions, and improves customer outcomes before disengagement turns into lost revenue.

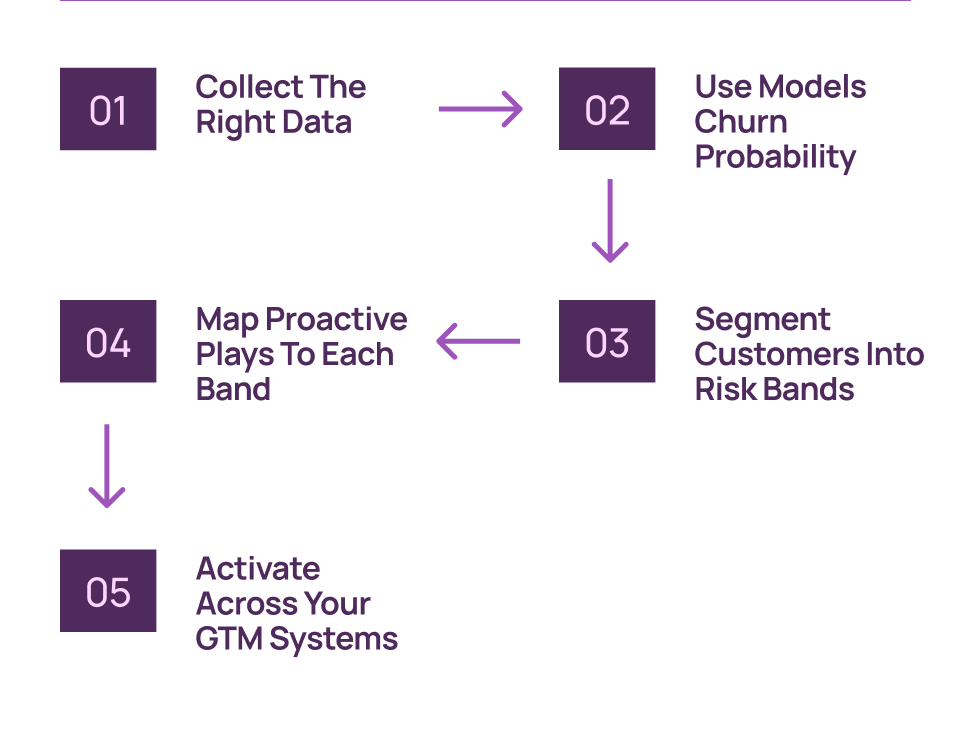

Here’s how the process works — step by step:

Step 1: Collect the right data

Pull structured signals from across the customer lifecycle, including:

- Product usage telemetry

- Support interactions and ticket velocity

- Customer success notes and QBR insights

- Billing behavior and contract history

These inputs form the foundation of your retention model.

Step 2: Use models churn probability

Use machine learning or rules-based logic to calculate churn risk scores. These models analyze patterns in the data to predict which customers are most likely to disengage.

Step 3: Segment customers into risk bands

Group accounts into clearly defined tiers — typically low, medium, and high churn risk — to prioritize your efforts and allocate resources efficiently.

Step 4: Map proactive plays to each band

Design specific interventions for each risk level. Examples include:

- Low-risk: reinforcement plays or product milestone messaging

- Medium-risk: re-engagement campaigns or executive check-ins

- High-risk: loyalty incentives, re-onboarding, or direct CS outreach

Step 5: Activate across your GTM systems

Deploy campaigns through your CRM, MAP, or customer success platform — enabling coordinated action across marketing, CS, and revenue teams.

At Directive, we’ve seen firsthand how predictive modeling tied to lifecycle marketing transforms retention from a reactive struggle into a repeatable growth engine. By connecting retention insights directly to lifecycle marketing, we help teams reduce churn, increase NRR, and unlock expansion revenue.

Why a Retention Strategy Is Critical for Modern B2B Brands

Customer acquisition is expensive. Retention is efficient.

Studies from Bain & Company and Harvard Business Review show that even a small increase in customer retention, as little as 5%, can boost profits by 25–95%. In SaaS, where margins are high and contracts recur, the compounding effect of retention is even more pronounced.

For subscription-based businesses, retention isn’t just an operational KPI, it’s the foundation of sustainable growth. Metrics like Lifetime Value (LTV)Annual Recurring Revenue(ARR), Gross Revenue Retention (GRR), (Net Retention Rate) NRR, and churn rate are directly shaped by how well you retain and expand your customer base. Without a strong retention strategy, every quarter starts from zero, with teams scrambling to replace lost revenue instead of compounding existing growth.

High-performing B2B brands treat retention as a growth engine that drives:

- Predictable revenue and better forecasting confidence

- Stronger LTV/CAC ratios by maximizing the value of every customer

- Increased expansion ARR through upsells and cross-sells

- Improved GRR and NRR that resonate directly with boards and investors

Retention isn’t just about keeping customers longer, it’s about building loyalty and lifetime value that powers efficient, sustainable growth.

What Is Predictive Retention Modeling?

Predictive retention modeling is the practice of using machine learning and behavioral data to forecast which customers are most likely to churn, before they show obvious signs of leaving.

Instead of reacting to downgrades or missed renewals, this approach helps teams identify risk early and engage proactively. It shifts retention from reactive firefighting to structured, data-driven action.

At its core, predictive modeling powers three essential functions:

- Churn forecasting — Pinpoints which customers are most likely to leave based on historical and real-time data.

- Risk segmentation — Groups accounts by churn probability (e.g., low, medium, high risk) to guide prioritization.

- Proactive engagement — Triggers targeted plays across marketing, CS, and revenue teams before disengagement accelerates.

There are several common modeling techniques, each with tradeoffs in complexity and interpretability:

- Logistic Regression – Easy to explain and useful for straightforward binary churn classification, but more limited when dealing with highly complex data.

- Random Forests – Strong at capturing non-linear relationships and handling messy datasets; also better than logistic regression at managing large numbers of variables.

- Gradient Boosting (GBM/XGBoost) – Delivers high accuracy by detecting subtle churn signals; particularly effective with large feature sets compared to logistic regression.

- AutoML – Automates model training and tuning for faster deployment; also well-suited for handling many variables more efficiently than logistic regression.

The right model depends on your goals, whether you need speed, accuracy, explainability, or a mix of all three.

Most importantly, predictive retention modeling doesn’t live in isolation. It becomes most powerful when integrated across customer lifecycle marketing. By aligning predictive signals to each stage; onboarding, adoption, maturity, renewal, companies can embed measurable retention plays that scale across the entire journey.

In short, it’s not just about knowing who might churn. It’s about knowing when, why, and what to do next, automatically.

How to Use Smart Loyalty Incentives That Drive Real Results

Not all churn is preventable, but much of it is addressable.

Loyalty incentives are one of the most effective tools for influencing customer behavior at critical points in the lifecycle. When deployed strategically, they can improve renewal rates, deepen engagement, and even open doors for upsell and advocacy.

The key is timing and targeting. Incentives should feel earned, not random and should align to your customer’s current stage, account value, and risk profile.

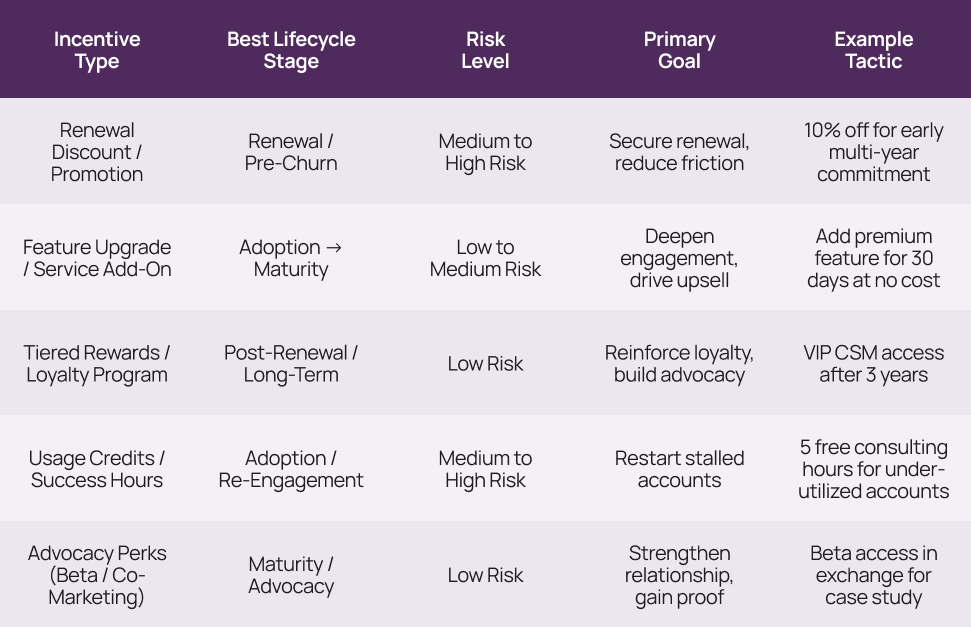

Types of Loyalty Incentives That Actually Work

Here are five categories of loyalty incentives that consistently drive results in B2B SaaS retention programs:

- Renewal-Driven Discounts or Promotions: Time-limited offers tied to contract renewals, such as multi-year pricing incentives, early-renewal discounts, or loyalty-based rate locks, can help secure longer commitments and reduce churn friction.

- Feature Upgrades and Service Add-Ons: For sticky but expansion-ready accounts, offering access to exclusive features, additional seats, or premium services can drive upsell value while reinforcing commitment.

- Tiered Rewards for Long-Term Customers: Implement a structured loyalty program that rewards tenure with escalating perks such as VIP support, dedicated CSMs, or strategic roadmap influence.

- Usage Credits or Success Hours: For strategic or at-risk accounts, usage-based incentives like platform credits, additional onboarding hours, or success workshops can re-engage stalled teams and unlock adoption.

- Advocacy Perks Offer your most engaged customers early access to betas, invite them to participate in co-marketing campaigns, or spotlight them at events. These perks build loyalty, reduce churn risk, and drive social proof all at once.

Incentives should never feel like bribes. When framed around value — not desperation — they become powerful tools for protecting revenue, strengthening relationships, and scaling customer advocacy.

Personalization and Segmentation

Incentives only work when they feel relevant.

One-size-fits-all offers, like blanket discounts or generic thank-you emails, often underperform in B2B settings. The reality is that your customers are at different stages, with different needs, product usage patterns, and expansion potential. What motivates a new user won’t move the needle for a mature account.

That’s where predictive modeling comes in.

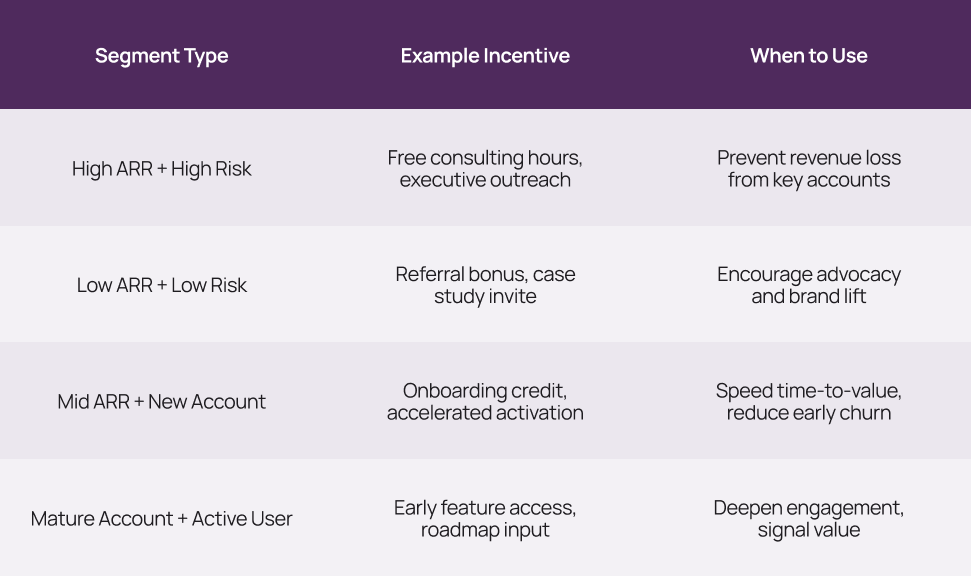

By using behavioral and lifecycle data, you can segment customers based on usage, risk, and revenue potential and align your incentive strategy accordingly.

Here’s how it plays out:

- Usage-Based Segmentation

→ Under-utilized accounts might receive free training credits or onboarding workshops to drive activation.

→ Power users might get access to new features, roadmaps, or time-saving automations. - Lifecycle-Based Segmentation

→ New customers could receive onboarding incentives (e.g., faster implementation, welcome bonuses).

→ Long-term accounts might unlock loyalty perks like executive QBRs, service upgrades, or VIP access. - Risk-Based Segmentation

→ High-risk customers trigger immediate high-value plays: usage credits, dedicated success hours, or retention-focused offers.

→ Low-risk accounts are nurtured toward advocacy with co-marketing invites or early beta access.

Predictive retention modeling doesn’t just forecast who’s at risk, it tells you what to do next. When paired with thoughtful segmentation, it becomes the engine behind high-impact personalization that actually moves revenue.

Balancing Incentives and Profitability

Loyalty incentives can reduce churn and extend customer lifetime value but if misused, they can quietly erode profitability. Over-discounting, especially during renewal cycles, often leads to compressed margins, lower LTV, and pricing inconsistencies across accounts. What starts as a retention tactic can quickly become a dangerous precedent.

The key is strategic generosity: designing offers that improve retention without compromising margin or setting unsustainable expectations.

To ensure incentives protect the business, high-performing SaaS teams implement clear guardrails:

- Discount caps — Limit renewal discounts to 15–20% to avoid pricing dilution

- Floor pricing policies — Set minimum pricing thresholds based on ARR or segment

- Contribution margin checks — Review impact before greenlighting any incentive

- Value exchange framing — Position offers around loyalty, not loss: e.g., “Renew early for added features,” not “Stay and we’ll discount”

Retention plays should not come at the expense of growth economics. When calibrated correctly, they protect LTV, preserve contribution margin, and reinforce scalable, efficient revenue growth.

Deploying a Retention Strategy That Reduces Churn in Real Time

Predictive retention only creates value when it’s operationalized — embedded into the systems, tools, and workflows your teams already use. Below is a practical step-by-step framework for launching a real-time retention strategy that reduces churn and drives measurable results inside a B2B organization.

Step-by-Step Approach

- Conduct churn analysis using predictive modeling

Start by feeding behavioral, usage, and support data into your predictive model. Identify patterns that correlate with churn and assign risk scores across your customer base. - Segment accounts by churn risk and lifecycle stage

Combine churn probability with account maturity — grouping customers into categories like new + low risk, mature + medium risk, or high ARR + high risk. This dual segmentation helps prioritize where to act and how. - Map incentives and messaging to each segment

Align retention plays to both risk level and lifecycle stage. For example:

- New + low risk → onboarding support

- Mid-stage + medium risk → usage credits

- Mature + high risk → renewal discounts or executive outreach

- Launch coordinated campaigns across your GTM stack

Deploy outreach through your CRM, MAP, or CS platform — making sure messaging, timing, and ownership are clearly defined across teams. - Operationalize real-time alerts and escalations

Set up triggers based on behavior thresholds (e.g., login drop-offs, missed QBRs, support friction) that notify success managers or trigger automated plays within your marketing automation platform. - Review performance and refine thresholds quarterly

Retention isn’t static. Analyze results, adjust feature thresholds, refresh messaging, and evolve your playbooks every quarter to match product updates, customer feedback, and business goals.

When predictive retention becomes a real-time system — not just a model — it drives faster interventions, stronger alignment across teams, and ultimately, a higher return on every customer you’ve already earned.

Operational Considerations

Even the best retention strategy will fail without operational alignment. Predictive models, loyalty incentives, and segmentation frameworks are only as effective as the systems and teams that support them.

To reduce churn in real time and at scale, you need more than a good playbook — you need executional rigor across teams, clean data, and automation built to move fast.

Here are the key operational pillars:

- Cross-Functional Alignment

Marketing, Customer Success, and Product must operate from a shared source of truth. That means:

- Unified dashboards with real-time retention KPIs

- Shared visibility into churn risk bands and campaign performance

- Clear roles: CS executes interventions, Marketing drives campaigns, Product builds the usage telemetry that powers it all

When these teams align around outcomes — not just activities — retention becomes a company-wide growth lever.

- Data Hygiene

Predictive models rely on consistent, clean inputs. Incomplete usage telemetry, mis-tagged support tickets, or inconsistent CRM updates will weaken risk scoring and create blind spots.

Operational success requires:

- Standardized data collection across tools

- A regular cadence for QA and enrichment

- Accountability for tracking usage, engagement, and lifecycle events across the stack

Without reliable data, retention models become guesswork.

- Automation Infrastructure

To scale, retention plays must be triggered — not manually executed. Real-time alerts, automated outreach, and dynamic segmentation ensure no high-risk account slips through the cracks.

Key enablers include:

- Lifecycle-based workflows in your MAP (e.g., HubSpot, Marketo)

- Trigger-based sequences in CS platforms (e.g., Gainsight, Catalyst)

- CRM workflows that route accounts to the right owner based on behavior

Automation turns retention from a manual firefight into a repeatable system that compounds over time.

When the data flows cleanly, the systems are wired tightly, and the teams are aligned — predictive retention shifts from strategy to real-world impact.

Predictive retention is only valuable if it leads to measurable results. To prove ROI — and earn budget, trust, and long-term adoption — you need to tie your strategy directly to outcomes that matter to the business.

Measuring the Success of Your Retention Strategy

Here’s how to track what matters and continuously optimize for performance.

Core Metrics of Success

The strongest B2B customer retention strategies are anchored to metrics that reflect both customer health and revenue efficiency. These include:

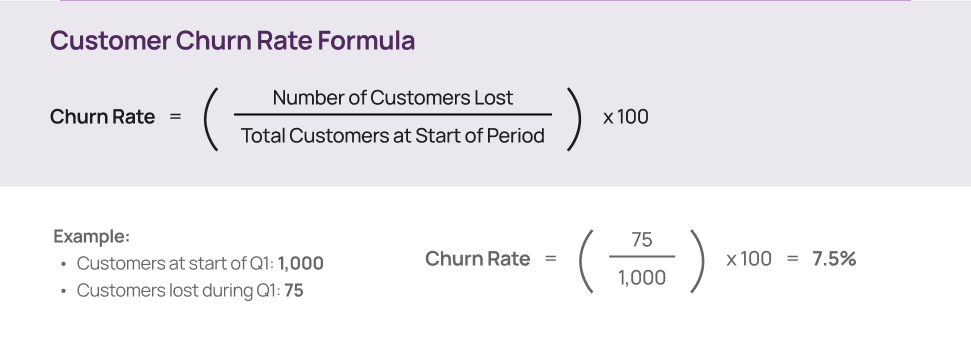

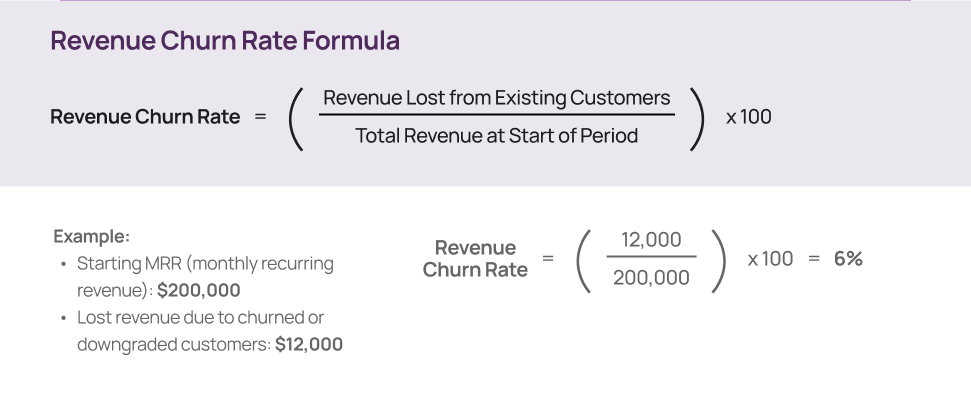

Churn Rate – Track both logo churn (lost customers) and revenue churn (lost ARR). A declining churn rate is the most direct sign that your retention plays are working.

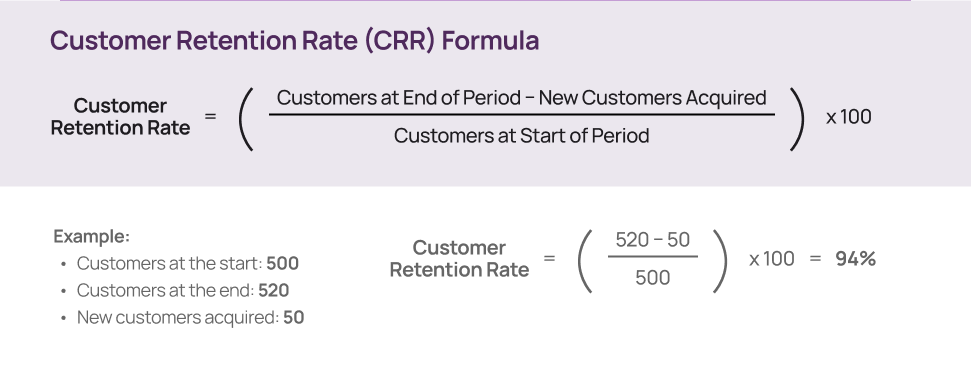

Customer Retention Rate (CRR) shows how well you’re keeping existing customers (excluding new ones), making it a key KPI for tracking retention performance — tip: segment by cohort, track quarterly, and use alongside churn and NRR for a full retention picture.

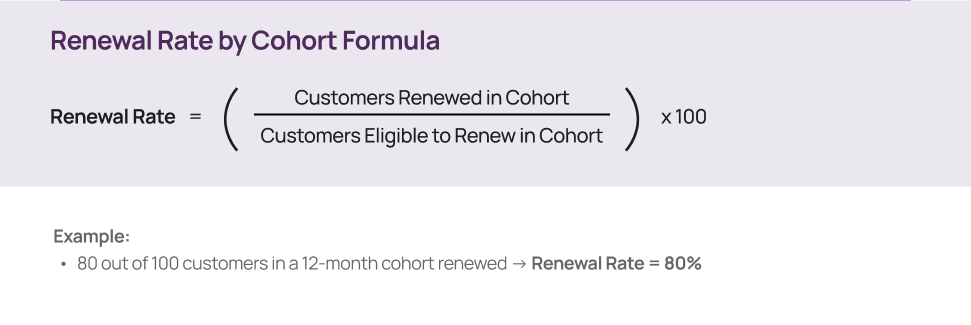

Renewal Rate by Cohort – View renewals through the lens of lifecycle, ARR tier, or product segment. This exposes which plays are effective and which accounts need different support.

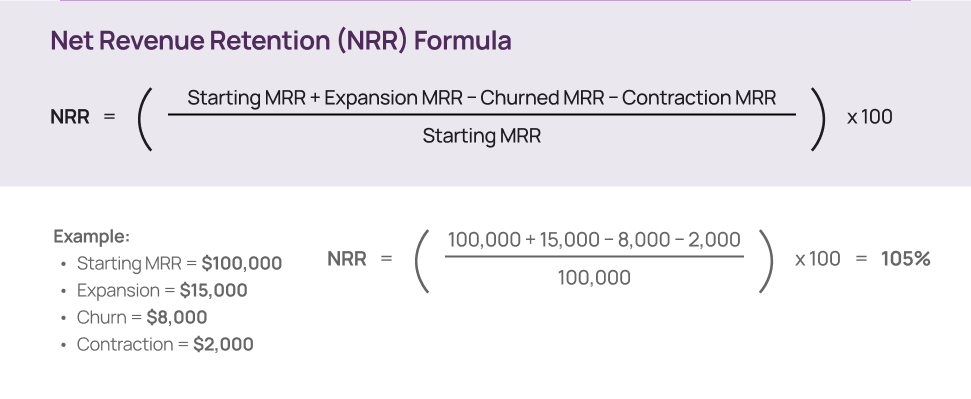

Net Revenue Retention (NRR) – The gold standard of SaaS health. If your retention strategy increases NRR by reducing churn and boosting expansion, it’s doing its job.

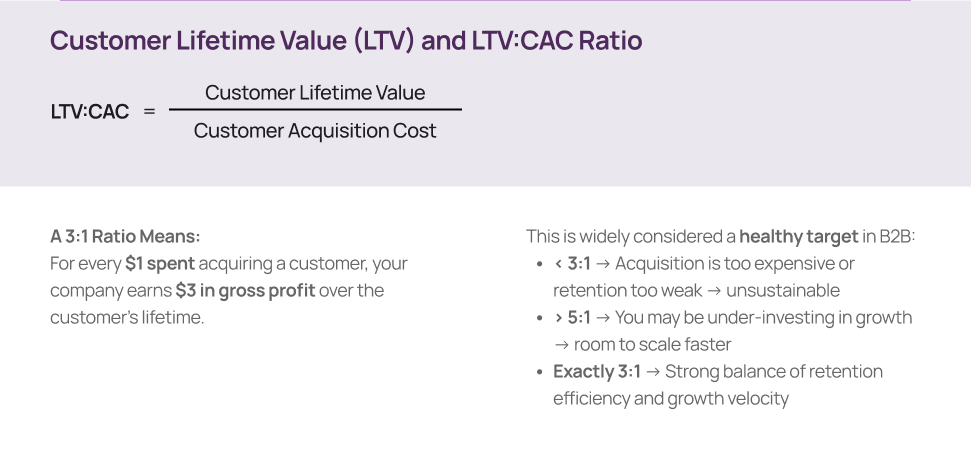

Customer Lifetime Value (LTV) and LTV:CAC Ratio – As retention improves, so does LTV — which in turn drives a healthier CAC payback window and more scalable growth.

These are not vanity KPIs — they’re metrics that show up in board decks and investor calls.

Measuring the ROI

To justify your retention investments, you need to show cost vs. revenue impact.

Let’s say you reduce churn from 12% to 9% annually. That’s a 25% improvement — and it compounds over every renewal cycle. If your average customer is worth $40,000 in ARR, that’s $1M+ in retained revenue across just 100 accounts.

Compare that lift to your total incentive or program spend — and your ROI becomes tangible.

Look beyond spend-per-incentive and measure:

- Cost per dollar retained

- Impact on expansion ARR from upsell-triggered plays

- Time-to-renewal velocity improvements

A retention strategy isn’t just about saving revenue — it’s about multiplying it through efficient, long-term growth.

Continuous Optimization

Retention isn’t static — it evolves with your customers. To keep your strategy sharp:

- A/B test incentives, offers, and campaign timing

See what moves each segment and refine based on behavioral responses. - Monitor live performance data

Use platform telemetry and campaign analytics to see which plays are driving renewals vs. being ignored. - Feed insights back into your models

As patterns emerge, retrain your predictive models with real-world results. Over time, this creates a compounding effect: better segmentation, more relevant incentives, and stronger revenue performance.

B2B SaaS customer retention strategies should be treated as a living system, not a one-time campaign. The more you optimize, the more efficient and profitable it becomes.

How Directive Helps You Maximize Retention Through Customer Lifecycle Marketing

At Directive, retention is embedded into our holistic performance marketing approach.

Our holistic approach helps B2B SaaS and enterprise brands design and execute B2B customer retention strategies that don’t just keep customers, they expand them.

We help you maximize lifetime value through six core pillars:

- Customer Journey Mapping – Identify churn risks and surface opportunities across the entire lifecycle.

- Strategy Development – Build tailored B2B SaaS customer retention strategies that connect retention to acquisition and expansion.

- Email Marketing Automation – Deliver personalized, scalable communication that drives engagement and advocacy.

- CRM Integration – Align data, touchpoints, and reporting to support high-impact B2B retention strategies.

- Performance Analytics – Use predictive modeling and lifecycle insights to anticipate churn and highlight upsell opportunities.

- Retention and Loyalty Programs – Launch programs that strengthen loyalty and power long-term revenue growth.

Directive has a track record of helping the fastest-growing SaaS and enterprise companies reduce churn, grow net revenue retention, and scale lifetime value. Our B2B SaaS retention strategies are built to drive measurable outcomes: reduced churn, higher LTV, and predictable revenue growth.

By connecting B2B retention strategies directly to full-funnel marketing and acquisition efforts, we ensure every investment compounds into pipeline growth and long-term success.

👉 Ready to cut churn and grow customer lifetime value? Talk to Directive’s lifecycle marketing experts today.

-

Lea Amiri

Lea Amiri

Did you enjoy this article?

Share it with someone!