If you’ve been in the Marketing Operations or Revenue Operations world for a while, you’re probably familiar with demand waterfalls. The original demand waterfall was published by SiriusDecisions (now part of Forrester) back in the early to mid-2000s. It introduced a number of novel concepts such as MQLs, SALs, and SQLs to the world and has been adopted by the vast majority of B2B brands.

As ABM gained popularity, the original demand waterfall no longer fit the needs of many B2B brands that were switching to ABM or hybrid go-to-market motions. So, a few years back, SiriusDecisions created a new version that introduced the concept of a “Demand Unit”. This version of the waterfall hasn’t taken off nearly as well as the original version did, but some B2B brands have picked up on it.

Now, there’s another version… released last year under the Forrester brand. You can see more information about this new version here.

This new version is a much more radical departure from the older version and has generated a lot of questions and concerns about how to implement it. In this article, we’re going to break down the biggest changes, what they mean for you, and some strategies for how to implement them in common tech ecosystems.

Let’s dive in…

All-In on Opportunities

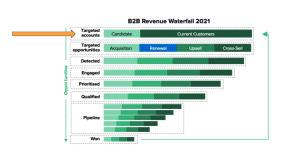

The biggest change, and the one that’s causing the most concerns, is that the new B2B demand waterfall proposed by Forrester is 100% based on Opportunities.

WHAT?!?

Yep… no more Leads, Contacts and Accounts. Well, they don’t go away completely. They are just far less important to the process than Opportunities. In this new model, the whole revenue team is aligned around Opportunities. The way that Forrester thinks about it is in the screenshot below.

Let’s break this down a bit further.

Opportunity Type

One thing that stands out in the above is the need to have four different Opportunity types; Acquisition, Retention/Renewal, Upsell, and Cross-Sell. You should already have something like this in your ecosystem now, but if you don’t, this is a pretty easy thing to get started with.

At the bare minimum, you need a field on the Opportunity field called “Type” or “Opportunity Type” with a picklist that allows the creator of the Opportunity to select one of these types. More sophisticated orgs may elect to use the Opportunity Record Type instead, which will give you more functionality, but let’s keep it simple for now.

Now, you may not need to have separate Opportunity Types for Upsell and Cross-Sell, depending on your company’s products and product strategy. So, all four aren’t required. The primary goal is to be able to differentiate between different types of Opportunities.

Opportunity Creation

If you’re used to the old style of demand waterfall, then you’re used to the Opportunity being created sometime between when the SDR team has validated the MQL and Sales has validated the prospect that the SDR team sent over. Different orgs create Opps at different points in the journey, but usually, it’s somewhere in there.

Based on the above graphic though, Opp creation is going to change dramatically in the new world. It’s going to happen far earlier in the process than what you’re probably used to. The exact “where” is still up for some interpretation though. For some orgs, you’ll want to create the Opp as soon as you’ve identified a target account (so the very first row of the funnel above).

For other orgs, you’ll want to create the Opp later in the funnel, either at “Targeted Opportunity” or “Engaged”. There is some flexibility here though.

We also need to talk about who creates the Opportunities. That’s going to be heavily dependent upon when in the journey you’re creating the Opps. And, it may also depend on the type of Opp.

If you’re creating the Opp at the very beginning of the journey, then that Opp creation should probably be automated, or created by Marketing. If you’re creating the Opp later in the journey, then the Opp creation should be owned by whomever is owning that stage of engagement… either the SDR or the Sales rep.

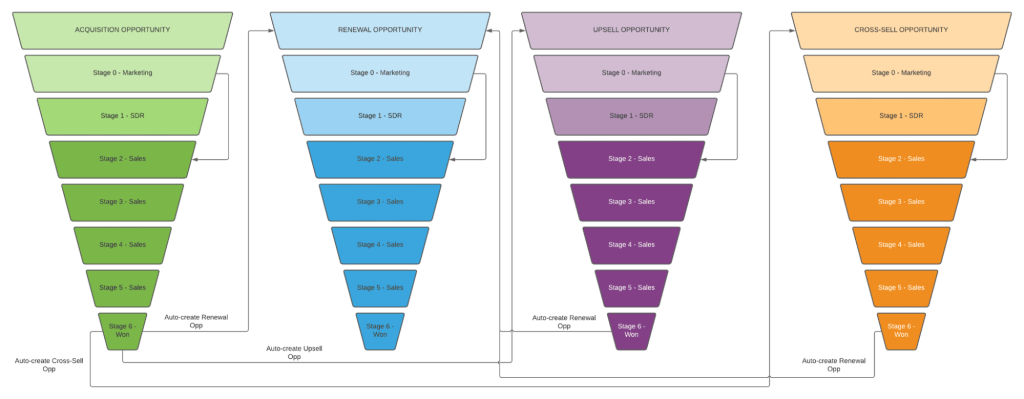

That works really well for the Acquisition Opportunity Type, but what about the others? We highly recommend automating that. Once the Acquisition Opportunity has been Closed Won, you can automate the creation of the Renewal Opp (with the close date based on contract term, and the amount based on the amount of the previous Opp). You can also create the Upsell Opp and the Cross-Sell Opp, as long as you use those Opp Types. Ownership for these Opps should be based on whomever is primarily responsible for these motions in the organization for current Customers.

What Happens to Leads?

This may be a big change for many orgs, but we’ve also seen a lot of orgs that have migrated away from using the Lead object already. If you’ve already done this migration, you probably already have a solution in place.

You can’t abandon the Lead object entirely though. The reason for this is that the vast majority of Marketing Automation Platforms (MAPs) only create Leads in CRM. Now, some of them can do Lead conversion, but they do it in a less than ideal way that leads to the creation of a lot of duplicate records (Contacts & Accounts). So, we don’t recommend that at all. We recommend using a lead-to-account (L2A) matching tool to do this for you. Our favorite is LeanData, but there are others in the market.

In order to set this up properly, you want your MAP to create Leads in your CRM. Then, you want LeanData (or your other L2A tool) to match that Lead to an existing Account. Once the match is identified, then your L2A tool will convert that Lead to a Contact and associate that Contact with the matched Account.

What happens if there is no match, or it’s a brand new Account? You can instruct your L2A system to take one of two different approaches. Option 1 is to convert the Lead and create a new Account. Option 2 is to alert a Revenue Operations team member that there is no match and have the RevOps person do a manual conversion and Account creation process. Option 1 is preferred, because automation is almost always preferred, but Option 2 works well if you want to have human eyes involved in the creation of any new Accounts.

During this L2A matching process–depending on when in the journey you’re creating your Opps–you may have the L2A tool also create the Acquisition Opportunity. Most of the L2A tools can do that as part of the conversion process.

Buying Groups/Committees

Another key element of the new B2B demand waterfall is the acknowledgement, operationalization and importance of buying groups or committees. As many of us in B2B know, oftentimes there is a group of people that are making buying decisions. You have influencers, decision makers, signers, and other people involved. The old demand waterfalls didn’t really care too much about buying groups, but the new one does… big time.

In order for this to work properly, we need to identify who the people are in our buying group(s). Because you could have several buying groups within one Account that lead to multiple Opportunities. And individual people may play a role–sometimes a different role–in multiple buying groups. So, we need to identify who the key players are in the Opportunities that we create.

How we do that is through the Opportunity Contact Role (OCR). And in the new demand waterfall, it takes on even greater importance.

Our buying groups need to be added to our Opportunities through the OCR. This should be done through one of a few methods.

Inbound Identification

When a new Lead comes in and is converted to the matched Account, we need to evaluate if this person is part of a buying group for a new Opp or an existing Opp. Once we figure that out, we manually add that person to the Opp through the OCR.

This is similar in motion to the traditional demand gen process that most of you readers are familiar with, with one exception. That exception is the process of possibly mapping this new person an existing Opp.

Research Based Identification

If you’re using ABM–which this new demand waterfall is highly compatible with ABM–this approach is very good. It also works really well if you’re creating the Opp at the very beginning of the journey.

In this methodology, your Marketing, Development and Sales teams are going to collaborate to identify all of the players that would be involved in the buying group, what their titles and roles could or should be. Then, you’re going to use a tool such as LinkedIn Sales Navigator, ZoomInfo or Clearbit to go find the actual people that make up that buying group. Once you find them, you’re going to import their information into your CRM and manually map them to their Opp via the OCR.

This is a very proactive methodology that helps all three teams (Marketing, Sales Development & Sales) identify, target and engage the folks that can help bring the Opportunity across the finish line.

Lead Scoring can also be used with this methodology to gauge the effectiveness of our outreach efforts at any stage in the buying journey. We can look at the collective lead scores, or the individual lead scores, to see if we’re making any progress. We can see if there are any members of the buying group that maybe are less engaged than others and target them even more.

This is a very productive methodology, but it’s a bit time intensive and requires some manual effort.

Customer Based Identification

This is probably the easiest and most efficient way to identify your buying group. And, it’s usually only used on Opps related to existing customers.

In many cases we may already know who the buying group is. When we do, it’s important that whomever owns the Opp at the earliest stage possible adds those folks to the Opp via the OCR based on their knowledge of the client company.

Changes to Buying Groups

It’s possible that buying groups can change… that people may come and go either based on their role, their status with the company, the type of Opp, etc. And our buying groups on the Opp should reflect that. There’s no reason why we can’t add and remove people to and from the buying group throughout the process as we learn more about who our buying group members are and the roles that they play. The more we keep this up to date, the better off we are.

Opportunity Stages

In the above graphic, you’ll notice that Forrester outlined several stages in the buying process. But, those may not apply to you and your organization. Or, you may choose to create the Opp later in the buyer journey than what is outlined in that image. Also, you will undoubtedly have new Opp Stages that are earlier in the journey than your current Stages. So, you’re going to need to reimagine your Opp Stages in your CRM, because that is how you’re going to do any kind of conversion tracking.

We’ve done this exercise using a LucidChart where we create a funnel with stages for each Opportunity Type that we’re going to create. Then, we figure out which stage(s) align to the marketing piece of the journey, which stage(s) align to the Sales Development piece of the journey, which stage(s) align to the Sales piece of the journey, and for the Customer Opp Types we also have to map out which stage(s) align to Customer Success/Support.

Once we go through that process, we have to give names to the stages and identify the transition rules and how an Opp is going to transition from one stage to another. This should all be outlined very explicitly, because some of this you’re going to want to automate. For example, for one client, we automated the process of moving from the final Marketing stage to the SDR stage based on one member of the buying group having a Lead Score greater than 100 points (similar to demand gen). That may or may not work for your org though.

Another key element of this process is the need to outline all of the handoffs–or better yet, handshakes–that take place as part of the process. In the earlier instance of the demand waterfall, those were usually handoffs. Those handoffs were almost always inefficient, lazy, and were one of the biggest sources of leaks in the funnel. So, we recommend more of a handshake than a handoff. You want to explicitly outline how that handshake is going to happen. What does the RACI look like, who owns which aspects, who owns the next step, what the next step is, and the SLAs for each step are all things that have to be considered.

This also happens to be where this new demand waterfall will help you… and that’s with reporting.

Reporting

Please raise your hand if you’ve cursed SFDC and the problems with reporting across the Lead and Contact divide. If your hand just punched a hole in your roof, you’re not alone. We’re all with you.

This new demand waterfall solves for that though. Because now, all of your reporting for stages, conversions, aging and velocity are all done through one object… the Opportunity object. AND, since you’re breaking your Opps into different types, you’ll have several different types of funnels that you can report on… one for each Opp Type.

This makes your reporting much easier and much more efficient. But, you can’t just rely on traditional Opportunity reporting to do this. If you do, you’ll leave a lot of reporting value on the table.

We recommend creating a date field for each Opportunity Stage for each Opportunity Type.

Note: This is where it becomes helpful to use Opportunity Record Type instead of just an Opp Type field so that you aren’t cluttering up the Opportunity object with a ton of fields.

With the date fields in place, you need automation to stamp the date that the Opp transitioned into that new stage. Once you’re stamping dates into those fields, your ability to report on stage conversions is really quite endless.

Some of you may be thinking that this date stamping thing is a bit of overkill because SFDC already tracks stage transitions. And, in some ways, you’re right. But, there are a few problems that this does solve for.

First, if you just rely on SFDC’s out-of-the-box stage tracking (using the History Tracking), you’re limited to one report type that you can use, and that’s the Opportunity History report type. That report type limits your ability to relate your Opp reporting to any other objects. I’m thinking about objects like Products, Campaigns or Attribution objects.

Second, if you rely on the out-of-the-box stage tracking, you’re going to have to use SFDC’s reporting. You can’t export that data into a BI tool such as Tableau or Power BI very well.

Thirdly, if you rely on the out-of-the-box stage tracking, the reporting in SFDC is still lacking a bit. It makes it more difficult to try to do velocity and aging reports than if you have the dates stamped in actual fields.

Closing

Many of the answers to the question, “how do I implement this thing,” come down to that it’s going to be a bit different for each organization. It’s not a one-size-fits-all or even a one-size-fits-most proposition.

If you’re going to make a shift to this new demand waterfall–and it does have some advantages–you’re going to need to do the hard work of reimagining how you go to market. All of your teams that are involved in the revenue process are going to have to get on the same page for this change. If one team is onboard, then you’re not going to be able to make this change. But, that’s one of the big wins of moving to this model. Marketing, Sales Development, Sales and Customer Success should be much more aligned once this model is in place. And once those teams are aligned, you should have much less friction and fewer leaks in your sales process.

-

Drew Smith

Did you enjoy this article?

Share it with someone!