What is Lifetime Value?

Lifetime value (LTV) is an estimate of the average revenue a single customer will produce throughout their lifespan as a customer. The average revenue generated or “worth” of a customer can help a business make a lot of economic decisions that directly impact the company’s resources, marketing budget, forecasting, profitability, and more.

Lifetime value is an especially important metric in subscription-based business models where customers are called to engage with the company in various ways. Lifetime value is really all about keeping a business sustainable through its customers. Without customers, a business cannot survive in the short or long term.

How Do You Calculate Lifetime Value?

Calculating lifetime value can be done in a variety of ways. When working with a subscription model, for example, a simple way to calculate the lifetime value of a customer is to take the average monthly amount expected from each customer and then divide it by your churn rate. A churn rate is a rate at which you lose customers each month.

For example, if you charge $200 per month and your churn rate is 2%, then your lifetime value for a brand new customer is 200/0.02, or $10,000. This means that a customer’s expected lifetime in this example value is 50 months, which equals to a little over 4 years.

So what about companies without a subscription model? In these cases, you look at the total income you expect to gain from a new customer and include everything from add-ons to upsells that you expect from the customer as well.

You can calculate this by multiplying the average order value (AOV) by the number of expected purchases and time of engagement. With this in mind, the lifetime value of a customer can actually increase or decrease over time depending on your company’s offerings and ability to grow the account.

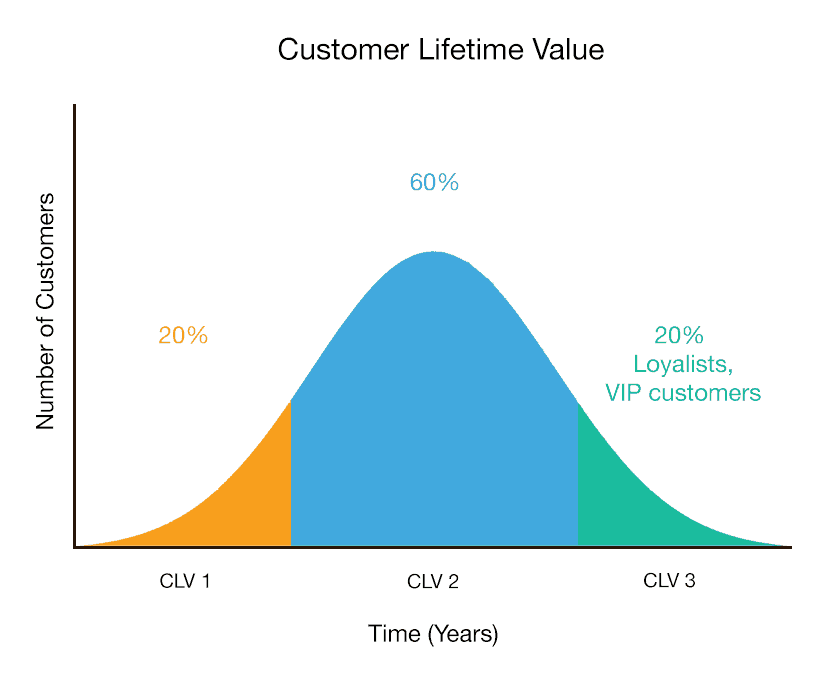

When calculating lifetime value, you have to remember that your customers are real people, and people can be unpredictable. Different types of customers can have different lifetime values, especially when you consider that your business will have different pricing levels for your different product or service offerings. To make things a little easier, you should do your best to calculate the lifetime value of different customers based on the pricing segment they fall into.

For example, if you have three different levels of software packages that you offer, you must create a lifetime value based on the historical data of each level of software package. This will create three different lifetime value metrics that you can then use to calculate growth, retention rates over time, revenue forecasting, and more.

How Do You Use Lifetime Value Once You Have It?

It is very difficult to forecast for future revenue potential without calculating lifetime value. It is an important variable because each new customer you obtain brings in new revenue per month and throughout their estimated lifetime as a customer.

Lifetime value can be used to figure out the marketing budget a company needs for optimal success. With the lens of the customer’s lifetime value, you can add lifetime value segments to customer personas, which can reveal how valuable retaining customers can be.

This also puts into perspective the customer acquisition cost (CAC), which is the initial cost of acquiring one new customer. The customer acquisition cost for each segment should be lower than the lifetime value of a new customer, meaning that you’re getting more out of each customer than you are spending to acquire them.

Lifetime value can also be applied to resource allocation for current customers. When you can segment your customers according to their lifetime value, you can then allocate more resources towards acquiring and maintaining certain customers.

If a group of customers has a high lifetime value, they should receive more resources depending on the stage of the customer lifecycle they are in – especially if they are nearing the end but have the potential for renewal. Conversely, if a customer has a low LTV, they will need a different level of attention for maintenance and overall retainment. Keep this mind when calculating and analyzing lifetime value.

How Can You Increase Lifetime Value?

Increasing the lifetime value of your customers is a worthy goal because it will reduce churn, increase retention rates, and increase the long-term profitability of your company. To reduce churn, it is important to have different retention strategies in place tailored for different lifetime value segments.

This level of intentionality helps to reduce churn because you are taking care to ensure that each customer matters, is noticed, and cared for.

For example, say the expected lifecycle of a customer is 4 months. You can create a package or promotion that lasts 6 months or bring in an account manager towards the end of the customer’s cycle to increase retention efforts and improve the likelihood of renewal.

When you boil it down, the only true way to increase lifetime value is to provide a quality product, quality service, and quality support that provides the customer with a great experience with your company. Not only will they want to maintain the membership as a customer, but they are more likely to be a loyal advocate for your brand.

From a digital marketing perspective, lifetime value can be generated starting with the experience from the website or from the initial advertisement or blog post viewed. Whether you are looking for a boost in conversion rates, or SEO and PPC services, ensure that you are giving your potential customers a good first impression.

Book a call today to find out how we can drive more valuable customers with our proven Customer Generation methodology.