Customers don’t come cheap.

To get a technology buyer through the sales funnel, it takes more than just good marketing ideas and sales tactics. It requires money.

In the past, marketing has often earned a reputation for spending more money than it generates.

But as more and more businesses began to view marketing as a core revenue-generating function rather than a frivolous one, it put the pressure on marketing leaders to get smarter about how they’re spending their budgets.

Needless to say, the days of “spray and pray” marketing are long gone.

If you expect to get executive buy-in for your marketing initiatives, you have to be able to vouch for their profitability (and have the numbers to back it up).

Through working with countless SaaS clients over the years, our team at Directive has zeroed in on the LTV:CAC ratio as one of the most useful measures of marketing efficiency and effectiveness — especially when comparing one channel to another.

Lucky for you, we’ve gone through our fair share of trial and error to come up with an easily replicable LTV:CAC model that anyone can use.

No number crunching necessary.

And if you’re new to the financials of SaaS marketing (and the jargon that comes with it), don’t worry. We’re going to break down LTV:CAC piece-by-piece.

What is customer acquisition cost?

Customer acquisition cost (CAC) is a measure of how much it costs to acquire a new customer. The lower your CAC is, the better your profit margins are. A low CAC is also indicative of efficient marketing and sales operations.

To calculate CAC for a specific marketing channel, take the total number of marketing expenses associated with that channel and divide it by the number of new customers.

When tallying up expenses, be sure to include employee salaries, agency fees, software costs, production costs, and overhead.

And don’t skip out on the details. You’re using these numbers to make big decisions, so it’s worth your time to go through and figure out exactly which expenses are going into your marketing activities.

Another thing to consider is attribution. Not every customer that your business acquires is going to come from the same channel. In your calculations, include only the number of customers that have been attributed to the specific channel that you’re measuring.

Let’s run through a quick example. Company X spent $100,000 on social media marketing last year. During that period of time, 10 new customers were attributed to that channel. Do some simple math and the CAC for social media comes out to $10,000.

It’s worth noting that this specific model is built to measure CAC for one isolated marketing channel. If you want to measure CAC across all of your sales and marketing activities, simply include all sales and marketing expenses in your formula.

Now, you’re probably wondering: what’s considered a “good” customer acquisition cost?

To find the answer, you have to take customer lifetime value into consideration.

What is customer lifetime value?

Customer lifetime value (CLTV or LTV) is an estimate of how much revenue a business can expect to acquire from a single customer throughout the duration of their partnership. It’s a useful measure that allows businesses to determine how much can be spent on customer acquisition activities.

Before you can calculate customer lifetime value, there are a few other figures you need to know first:

Average order value

Average order value is the amount of revenue you earn per customer. Since SaaS businesses operate on a subscription model with varying contract lengths, we recommend measuring average order value by the number of months.

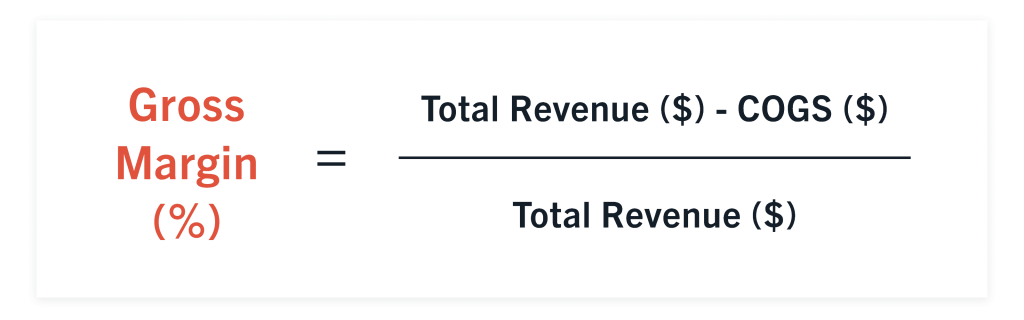

Gross margin

Gross margin measures the difference between revenue and cost of goods sold (COGS). It is commonly expressed as a percentage.

To calculate gross margin, subtract your COGS from the total revenue. Then, take that number and divide it by total revenue to get your final percentage.

COGS includes any expense that goes into delivering your product to the customer. This includes items such as customer support employee salaries and software hosting expenses.

The higher your gross margin is, the better.

Average customer lifespan

Average customer lifespan (ACL) is the average amount of time that a customer stays a customer. It’s usually measured from the first to the last order date of the customer’s contract. In our CLTV model, it’s expressed in months.

Churn rate

If you don’t know your ACL, you can use customer churn rate to calculate CLTV instead. Churn rate is the percentage of customers that cancel their subscription during a set time period.

The goal is to have your customers stick around long enough to recoup the amount of money it took to acquire them. A low churn rate is a sign that your customers are satisfied with your solution and are deriving enough value to keep paying for it.

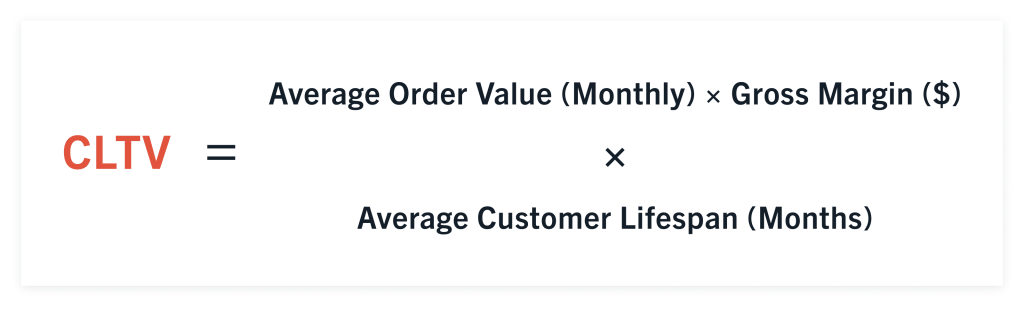

How to calculate customer lifetime value

There are two ways you can calculate customer lifetime value. If you do know your average customer lifespan, use this formula:

If you don’t have a figure for ACL, but you do know your churn rate, use this formula:

Let’s run through a quick example:

Company X has a monthly average order value of $7000 and a gross margin of 63%. Its average customer lifespan is 16 months.

(7000 * 63%) *16 = $70,560 CLTV

What is LTV:CAC?

LTV:CAC is a ratio that measures customer lifetime value against customer acquisition cost. It’s a convenient way to gain insight into how profitable your customers are and measure the effectiveness of your sales and marketing activities.

To find your LTV:CAC ratio, you simply take LTV and divide it by CAC.

Using LTV:CAC to prioritize marketing spend

Now that you know what goes into finding LTV:CAC, let’s talk about what to do with it.

Ideally, you want to have a LTV:CAC ratio that is at least 3:1. This means that for every dollar spent on marketing, you’re getting 3 dollars of lifetime value back from your customers.

Anything lower than 3:1 indicates that the marketing channel you’re measuring is inefficient and costly. It doesn’t take a math expert to see that if procuring customers is costing you more than the profit they’re bringing in, you’re not operating on a very sustainable business model.

That said, a low LTV:CAC ratio doesn’t mean your business is set for failure. Take it as a warning sign that shows you need to revisit your marketing activities and figure out where to cut costs.

A ratio higher than 3:1 means that the channel you’re measuring is operating at optimal efficiency and you may even be under-investing in it.

When you’re evaluating different marketing channels, LTV:CAC is a fairly simple way to see which ones are bringing in the most valuable customers. From there, you can double down on the channels that are the most profitable and re-consider the others. When you build this into your regular reporting routine, you’ll also be able to monitor channel performance over time.

Other agencies might help you get discovered in search.

Conclusion

Formulas and ratios might not be the most exciting part of being a marketer, but they serve a critically important purpose. In SaaS, few can afford to allocate capital to marketing channels that aren’t generating a meaningful profit. Getting comfortable with these numbers will only help you be more involved in your business and gain a deeper understanding of how your efforts are driving impact.

Other agencies might help you get discovered in search.