What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) is a SaaS marketing metric that quantifies the average total customer acquisition spending needed to generate a single new customer during a given time period.

B2B SaaS marketing teams and executive leaders use the CAC metric to measure the efficiency of sales/marketing activities and assess the company’s overall profitability and growth trajectory in conjunction with other SaaS metrics like customer lifetime value (LTV).

How is Customer Acquisition Cost (CAC) Calculated?

To calculate Customer Acquisition Cost (CAC) for a given time period, you need two pieces of information:

- Total Customer Acquisition Spend – You can determine your total customer acquisition spend in a given time period by adding up all of your sales/marketing spend for that time period.

- Number of Customers Acquired – Include any new customers that your business acquired during the specified time period.

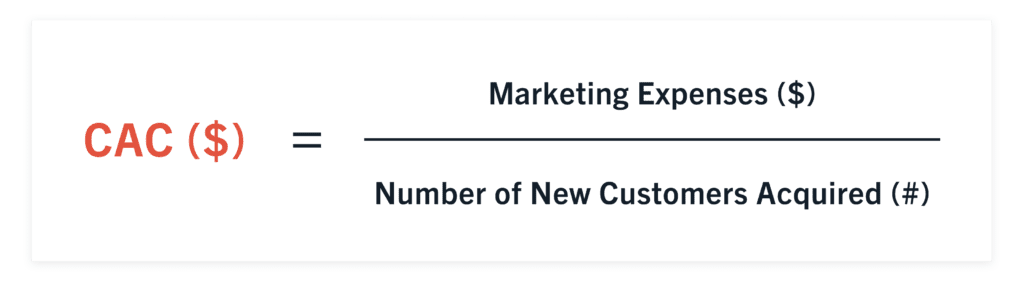

The formula for determining your customer acquisition cost (CAC) for a given time period is:

CAC = (Total Customer Acquisition Spend)(# of Customers Gained)

Example 1: Simple CAC Calculation

You are the RevOps manager at a B2B SaaS company and you want to calculate your company’s CAC for Q1 of the fiscal year.

You review your company’s financial records and marketing reports, determining that the company spent a total of $107,500 on sales and marketing activities during the specified time period. Then, you look at your company CRM and discover sales data showing that the business gained 17 new customers during the specified time period.

You can calculate your CAC as:

CAC = ($107,000)17 =$6,294.12

Tackling the CAC Attribution Problem

One of the problems you may encounter when working with the CAC metric is the CAC attribution problem. Here’s how it works:

Imagine you’re the RevOps manager in a B2B SaaS company where the average sales cycle length is 3 months.

If you wanted to calculate CAC for the most recent month, you would realize that much of the customer growth during the month was generated by sales/marketing activity in the months before. You would also realize that much of your sales/marketing activity (and spending) during the month won’t generate new customers until two or three months down the road.

All of this means that using the simple CAC formula will incorrectly associate last month’s sales/marketing spend with last month’s new customer growth. To deal with the CAC attribution problem, we can use an alternate formula for CAC:

CAC = (Total Customer Acquisition Spend in Previous Period)(# of Customers Gained)

Example 2: Sales Cycle CAC

You are the RevOps manager at a B2B SaaS company and you want to calculate CAC for Q2 of the fiscal year.

You know that your company’s average sales cycle length is 3 months, so you reason that your company’s customer growth in Q2 can be attributed to its sales/marketing spending in Q1. You add up your company’s Q1 customer acquisition spending and find that you spend $131,600. You then look at CRM and find that your company gained 11 customers in Q2.

You can calculate your CAC as:

CAC = ($131,000)11 =$11,909.09

What is Included in Customer Acquisition Cost (CAC)?

The most common challenge that B2B SaaS companies run into with the CAC metric is failure to properly account for customer acquisition spending.

Because while it’s fairly easy to determine how many new customers your business won during a given time period, it’s quite a bit more complicated to accurately account for every dollar that your business allocated to customer acquisition spending during the same time period.

To get the most accurate measurement of CAC, you want to include every last dollar of customer acquisition spending in your calculation, including:

- Paid search advertising spending

- Social media advertising spending

- Sponsored content spending

- Freelancer and marketing contractor payments

- Marketing personnel salaries and bonuses

- Sales personnel salaries and bonuses

- Real estate and other overhead costs associated with maintaining office space and working environment for customer acquisition teams.

Why is Customer Acquisition Cost Important?

Your Customer Acquisition Cost (CAC) determines how efficiently your business acquires new customers that add revenue to its bottom line.

Once you know your CAC, you can analyze the performance of your business in various ways by analyzing CAC alongside other metrics.

CAC Payback Period

Your company breaks even on customer acquisition costs when the customer generates enough revenue to cover their CAC. You can quantify the CAC payback period by determining your CAC and dividing it by average MRR per customer.

Example 3: CAC Payback Period

You are the RevOps manager of a SaaS business with CAC of $5,500 and MRR of $729. You can calculate your CAC payback period as:

CAC Payback Period = ($5,500)$729=~7.54 months

Based on these figures, it takes an average of 7.5 months for your business to earn back the money it spends on acquiring a new customer.

LTV:CAC Ratio

By taking a ratio of your customer lifetime value (LTV) and CAC, you can determine the profitability ratio for each new customer your business generates.

Example 4: LTV:CAC Ratio

You are the RevOps manager of a SaaS business with a CAC of $5,500 and LTV of $17,300. You can calculate your LTV:CAC ratio as:

LTV:CAC Ratio = ($17,300)($5,500) = 3.145

This LTV:CAC ratio reveals that your business is generating $3.14 in revenue for every dollar that it spends on customer acquisition.

What is a Good Customer Acquisition Cost?

So – what is a good customer acquisition cost, and how much money should your business spend to acquire a new customer?

The answer depends entirely on your LTV.

If you have a CAC of $500 but each new customer is worth $2,500 to your business, you’re making a healthy profit. On the other hand, a CAC of $500 with an LTV of $400 means that you’re actually losing money by acquiring new customers.

As part of Directive’s Customer Generation methodology, we target an LTV:CAC ratio of 3:1, aiming to generate $3 of revenue for every $1 of marketing spend. An LTV:CAC lower than 3:1 means that you might not generate enough profits to cover your expenses, while a higher LTV:CAC signals an opportunity to accelerate growth even further by increasing sales/marketing spend.

Interested in learning more?

Book an intro call with us to learn how we’re optimizing CAC to drive results for our B2B SaaS clients.

Or, Join Society and get access to exclusive content and marketing tips from the SaaS marketing community and Directive team members.